The HMRC (Her Majesty's Revenue and Customs) allows you to claim certain expenses related to the use of your home for work purposes. These expenses can be claimed as a deduction from your taxable income, which can reduce the amount of tax you have to pay. The following expenses are allowable for the

Expenses for Small Business: Reduce Tax and Boost Your Bottom Line

By understanding the types of expenses you can claim as deductions, you can effectively lower your taxable income and keep more money in your business's pocket. Office Expenses From office supplies and stationery to rent and utilities, a range of office-related expenses can be claimed. Whether

How To Write A Business Plan

Writing an effective business plan helps you in the following ways; Think through your business idea A business plan forces you to think through your business idea in a comprehensive and systematic way. This can help you identify potential problems and challenges before you launch your business. Set

Best Business Books

Advanced business knowledge is not exclusive to MBA programs. You have the ability to learn everything necessary for success in life and the workplace on your own. The Personal MBA presents a curated selection of the finest business books, meticulously chosen after extensive research spanning over a

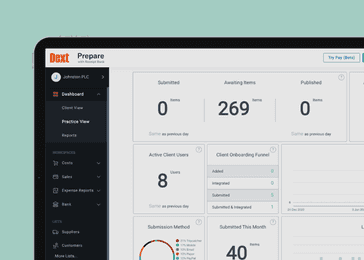

How to use Dext

A good guide is captured in this short video; You upload invoices and receipts by the following three methods;

Director’s Loan Accounts (DLA)

Director's Loan Accounts (DLA) refer to the record of transactions between a company and its directors regarding money or assets. In the UK, it is essential for directors to understand how these accounts work and how they are treated for tax purposes. One specific aspect related to director's loan

What are Dividends

A company must have sufficient distributable profits to pay a dividend. Distributable profits are the company's accumulated profits that are available for distribution to shareholders, after accounting for any losses, taxes, and other liabilities. The directors of the company must decide whether

Claiming VAT on Mileage

If you are an employee or a director and use your own car for business travel, your company can reimburse you in the following way (tax-free payments); 45 Pence per mile for the first 10,000 miles, every tax year. 25 Pence per mile for any miles in excess of 10,000. The above cover the cost of