Some common accounting terms include: Asset: A resource that a company owns and expects to benefit from in the future. Liability: A debt or obligation that a company owes to another party. Equity: The net worth of a company, calculated as the difference between its assets and liabilities. Revenue:

Reverse Charge VAT – Purchases of business-to-business (B2B) services from overseas suppliers

Purchases of business-to-business (B2B) services from overseas suppliers are subject to the reverse charge procedure. This means that the UK recipient of the service is liable to account for VAT on the supply, even if the supplier is not VAT registered in the UK. The reverse charge applies to

Reverse Charge For VAT – Construction Industry In The UK

In the UK, the reverse charge VAT applies to supplies of specific goods and services within the construction industry. It was implemented on 1st March 2021 and applies to businesses registered for VAT in the UK. Here's how reverse charge VAT works in the UK Applicable Transactions The reverse charge

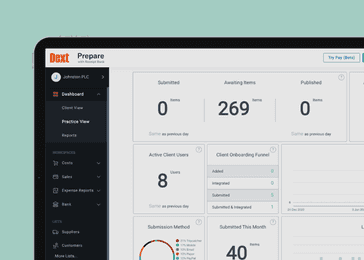

How to use Dext

A good guide is captured in this short video; You upload invoices and receipts by the following three methods;