If you are an employee or a director and use your own car for business travel, your company can reimburse you in the following way (tax-free payments);

- 45 Pence per mile for the first 10,000 miles, every tax year.

- 25 Pence per mile for any miles in excess of 10,000.

The above cover the cost of fuel, wear and tear, road tax, servicing, MOT and other running costs. If the business is VAT registered, it will be able to reclaim VAT on the fuel element only of the reimbursements.

You need to work out how much the fuel element of the mileage is in order to calculate the amount of the VAT that can be reclaimed. The advisory fuel rates are published by the HMRC.

IMPORTANT: The advisory fuel rates are updated every quarter so you need to check every time you raise a mileage claim.

Mileage Forms

How To Process in Xero – Worked Example

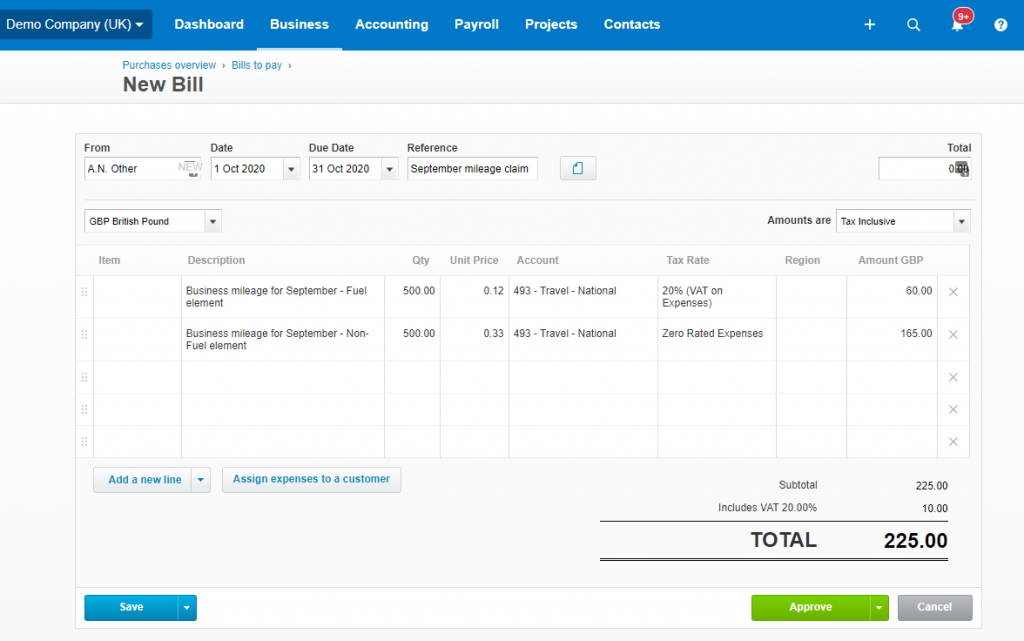

Xero works out the VAT element for you. Please process the expense claim in the following way.

Assumptions: 1700CC Petrol car and 500 business miles incurred. According to the HMRC’s Advisory Rates, the fuel element is 12 pence.

Let’s say you incurred 500 business miles in a particular month. In Xero;

- Add a new Bill.

- Populate the Bill as follows and click approve.

You can also process the mileage claims through the Expense module in Xero. Detailed instructions on how to process these can be found here.