Introduction In the ever-evolving landscape of marketing, where strategies come and go, there are a few timeless principles that stand the test of time. Seth Godin, a renowned marketing guru and best-selling author, has made significant contributions to the field with his profound insights and

Brian Tracy’s 10 rules for success

Aim for excellence Don't settle for mediocrity. Set your sights high and strive to be the best that you can be. Set goals and priorities Know what you want to achieve and then prioritize your time and activities so that you can focus on the most important things. Take action No amount of planning or

Mileage Rates – What Can You Claim?

If you use your own personal car for business travel then you can claim mileage expenses back from your business at the rates set by the HMRC. The mileage rates allowable in the UK are set by HM Revenue and Customs (HMRC). For the 2023 tax year, the rates are: 45p per mile for the first 10,000

Personal Fitness Trainers – What Expenses Can You Claim?

An Overview Some statistics about personal fitness training in the UK: Allowable expenses for sole traders As a sole trader, you will incur many expenses in the course of running your business. Some of these expenses can be deducted from your taxable profits, which can help to reduce

Making Tax Digital for VAT: a guide to the penalties

Changes to VAT penalties and interest charges if you submit a VAT Return for an accounting period starting on or after 1 January 2023. For VAT accounting periods starting on or after 1 January 2023 there are new penalties for VAT Returns that are submitted late and VAT which is paid late. The way

Selling Residential Property in the UK: Capital Gains Tax

You may have to pay Capital Gains Tax if you make a profit (‘gain’) when you sell (or ‘dispose of’) property that’s not your home, for example: The amount of CGT you pay depends on your income and the amount of profit you make. The basic rate of CGT is 18%, the higher rate is 28%, and the

How To Write A Business Plan

Writing an effective business plan helps you in the following ways; Think through your business idea A business plan forces you to think through your business idea in a comprehensive and systematic way. This can help you identify potential problems and challenges before you launch your business. Set

Reverse Charge VAT – Purchases of business-to-business (B2B) services from overseas suppliers

Purchases of business-to-business (B2B) services from overseas suppliers are subject to the reverse charge procedure. This means that the UK recipient of the service is liable to account for VAT on the supply, even if the supplier is not VAT registered in the UK. The reverse charge applies to

Reverse Charge For VAT – Construction Industry In The UK

In the UK, the reverse charge VAT applies to supplies of specific goods and services within the construction industry. It was implemented on 1st March 2021 and applies to businesses registered for VAT in the UK. Here's how reverse charge VAT works in the UK Applicable Transactions The reverse charge

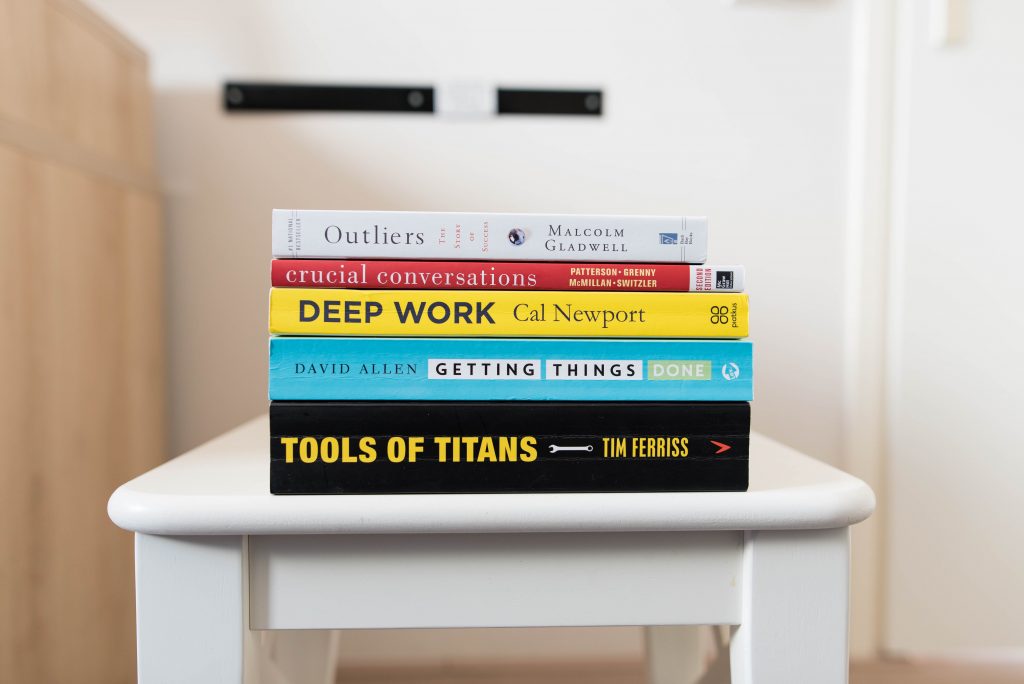

Best Business Books

Advanced business knowledge is not exclusive to MBA programs. You have the ability to learn everything necessary for success in life and the workplace on your own. The Personal MBA presents a curated selection of the finest business books, meticulously chosen after extensive research spanning over a