What is a Pension? A pension is a smart way to save for your future when you're no longer working. There are two main types: Personal Pension: You set this up yourself with a pension provider. Workplace Pension: Your employer contributes alongside you, usually by deducting a portion from your

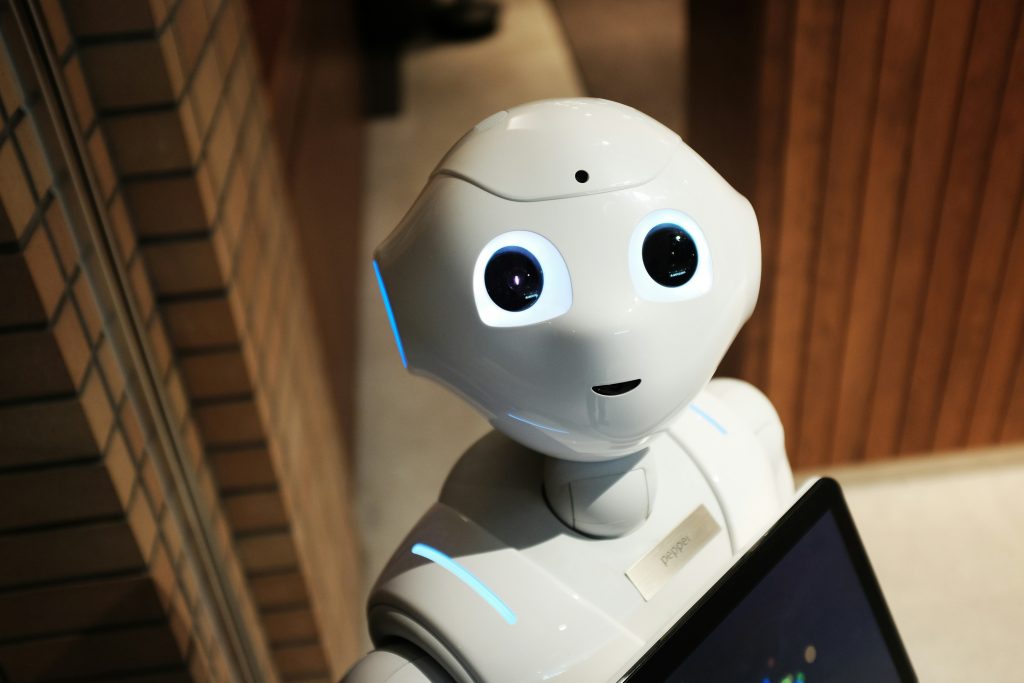

The EU Cracks Down on AI: What You Need to Know

While Hollywood paints a picture of AI leading to robot uprisings, the EU is taking a more practical approach, focusing on the real-world risks associated with AI technology. The newly implemented EU Artificial Intelligence Act aims to regulate how AI is used across industries, ensuring it doesn't

P11D Expenses & Benefits Explained for Employers

What are P11D forms? These forms report expenses and benefits given to employees that haven't been taxed yet. Your company needs to submit them to HMRC (the UK tax authority) annually. Who needs a P11D? Not everyone. Taxlab can advise you on this based on your specific situation. There are two P11D

Going Solo? Get Registered For Self Assessment Quickly

Starting your own business is exciting! But before you dive in, there's one key step: registering as self-employed with HMRC. This ensures you pay the right taxes. The good news? It's: Simple: The registration process is straightforward and hassle-free. One-time: You only need to register once,

Spring Budget 2024: Key Points and Upcoming Details – The Chancellor’s Final Spring Statement

This was the Chancellor's final Spring Budget before the upcoming election. He emphasized reforms focused on building a tax system that is: Simple and understandable: Making it easier for everyone to navigate the tax code. Fair and equitable: Ensuring everyone contributes their fair

Navigating the National Minimum Wage in the UK: A Guide for Businesses

As accountants, we know keeping up with complex regulations is paramount for your business's success. One crucial area? The National Minimum Wage (NMW). With changes on the horizon, here's a quick refresh to ensure you're compliant: Understanding the Basics The NMW sets the legal minimum hourly pay

Unlocking Opportunities: A Guide to Small Business Grants in the UK

Starting a small business can be a challenging but rewarding venture, and in the UK, entrepreneurs have access to a range of financial support through grants and loans. These resources play a crucial role in nurturing the growth of small enterprises, providing a financial foundation for innovative

Demystifying UK Payments on Account for Self Assessment: A Comprehensive Guide

Navigating the intricacies of UK tax regulations can be a daunting task, especially for self-employed individuals. One aspect that often causes confusion is the concept of payments on account, a mandatory requirement for certain self-assessment taxpayers. Fear not, for this comprehensive guide will

Navigating Uncertainty in Business: Embracing the Unknown

In the ever-changing landscape of business, uncertainty reigns supreme. From economic fluctuations to technological advancements, the ability to predict the future with certainty is a coveted yet elusive skill. As Edgar R. Fiedler, an economist, aptly put it, "He who lives by the crystal ball soon

Demystifying AI: A Beginner’s Guide to Artificial Intelligence

Artificial intelligence (AI) has become a ubiquitous term, often used interchangeably with science fiction and futuristic technology. However, AI is more than just science fiction; it is a rapidly evolving field with the potential to revolutionize our world. In simple terms, AI is the ability of