Measuring and improving business performance

- Setting clear goals and objectives: We work closely with you to establish your long term strategy and establish measurable and specific targets helps to determine what needs to be improved and how progress will be tracked.

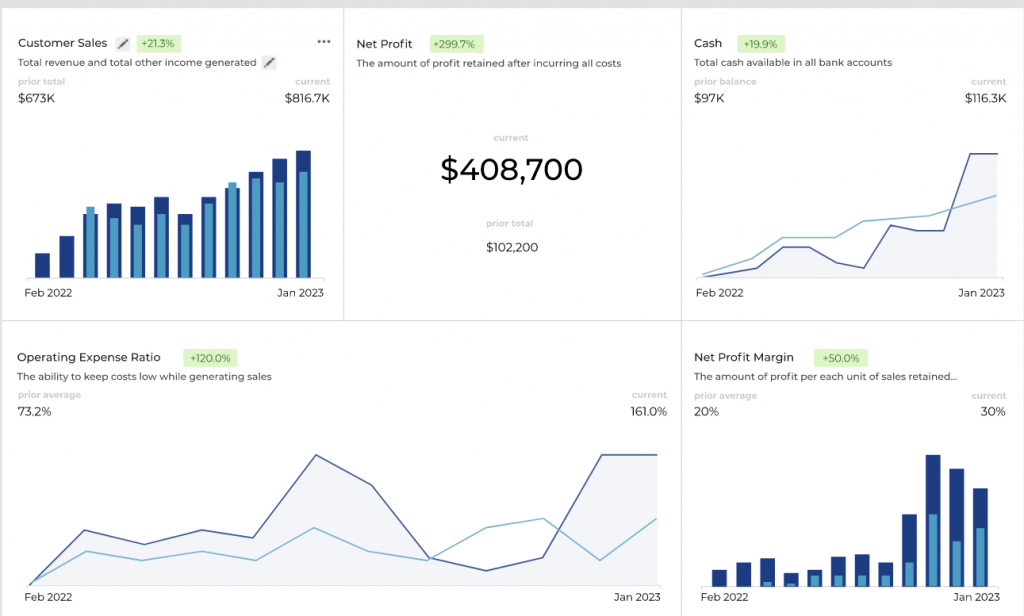

- Data collection: Gather relevant data and metrics, such as sales, customer satisfaction, and operational efficiency, to get a comprehensive view of the business performance.

- Financial analysis: We can provide insights into a company’s financial performance by analysing financial statements and other financial data, identifying trends and deviations from expectations.

- Cost control: We can assist in reducing costs by identifying areas of waste and inefficiency, and developing strategies for improving operational efficiency.

- Tax planning: We can help minimise tax liabilities and maximize tax savings by identifying tax planning opportunities and ensuring compliance with tax laws and regulations.

- Identifying key performance indicators (KPIs): Determine the most critical metrics that accurately reflect the performance of the business.

- Monitoring performance: Regularly review KPIs and other relevant data to identify trends, patterns, and deviations from expectations.

- Implementing improvements: Based on the analysis, implement changes to processes, systems, or other areas to improve performance.

- Continuous evaluation: Regularly reassess performance, collect and analyze data, and make further improvements as necessary to sustain and enhance performance over time.

- SWOT Analysis – assessing your strengths, weaknesses, opportunities and threats to develop your strategy.

Business benchmarking

Business benchmarking can be applied to various aspects of a company’s operations, such as financial performance, customer satisfaction, operational efficiency, and more. By comparing its own performance against established benchmarks, a company can gain insights into how it can improve and stay ahead of the competition.

-

Internal benchmarking: Comparing a company’s performance against its own historical data to identify trends and areas for improvement.

-

Competitive benchmarking: Comparing a company’s performance against its competitors to understand its relative strengths and weaknesses.

-

Industry benchmarking: Comparing a company’s performance against industry standards and best practices to identify areas for improvement.

-

Functional benchmarking: Comparing a specific aspect of a company’s performance, such as its supply chain, against industry benchmarks.

Benchmarking can be a valuable tool for companies of all sizes, helping them to identify opportunities for growth and improvement, and to stay ahead of the competition.

Example Reports